Three Data-Backed Reasons Why Car Insurers Should Digitize Claims Payments

We analyzed over 10k exposures that were closed in the last six months for our auto insurance customers. Here’s three data-backed reasons why insurers should go digital when it comes to auto claims payments.

Claims make up the majority of expenses for automotive insurance providers. Resolving your claims quickly is your holy grail. And for policyholders, claim resolution is both the reason to have auto insurance, as well as their biggest consideration when choosing a provider.

Enter digital claims payments.

Claims payout is the last mile of claims resolution, but belongs at the top of your priority list when it comes to digitization. We analyzed over 10k exposures that were closed in the last six months for our auto insurance customers. Here’s three data-backed reasons why auto insurers should go digital when it comes to claims payments:

1. Retain customers by delivering faster payments, for all exposures

A claim might result in multiple exposures, for example, a car accident might include collision coverage for the car holder, third-party property damage coverage, and third-party bodily damage coverage. According to our data, for every auto claim, insurers open 1.67 exposures – and the claim is not settled until all payees have received and accepted the payment. And according to a recent survey, 95% of policyholders say that the ease and convenience of claim payments, the speed of those payment, and the ability to access funds quickly has a direct impact on how satisfied they are with their insurer.

To this end, digital payments are the simplest way to expedite the claims process for both your policyholders and vendors. Claims payment is really the moment of truth in the mind of your policyholders and paying promptly goes a long way in building trust, strengthening brand loyalty, and creating return customers.

2. Improve efficiencies and reduce costs by expediting claims settlements

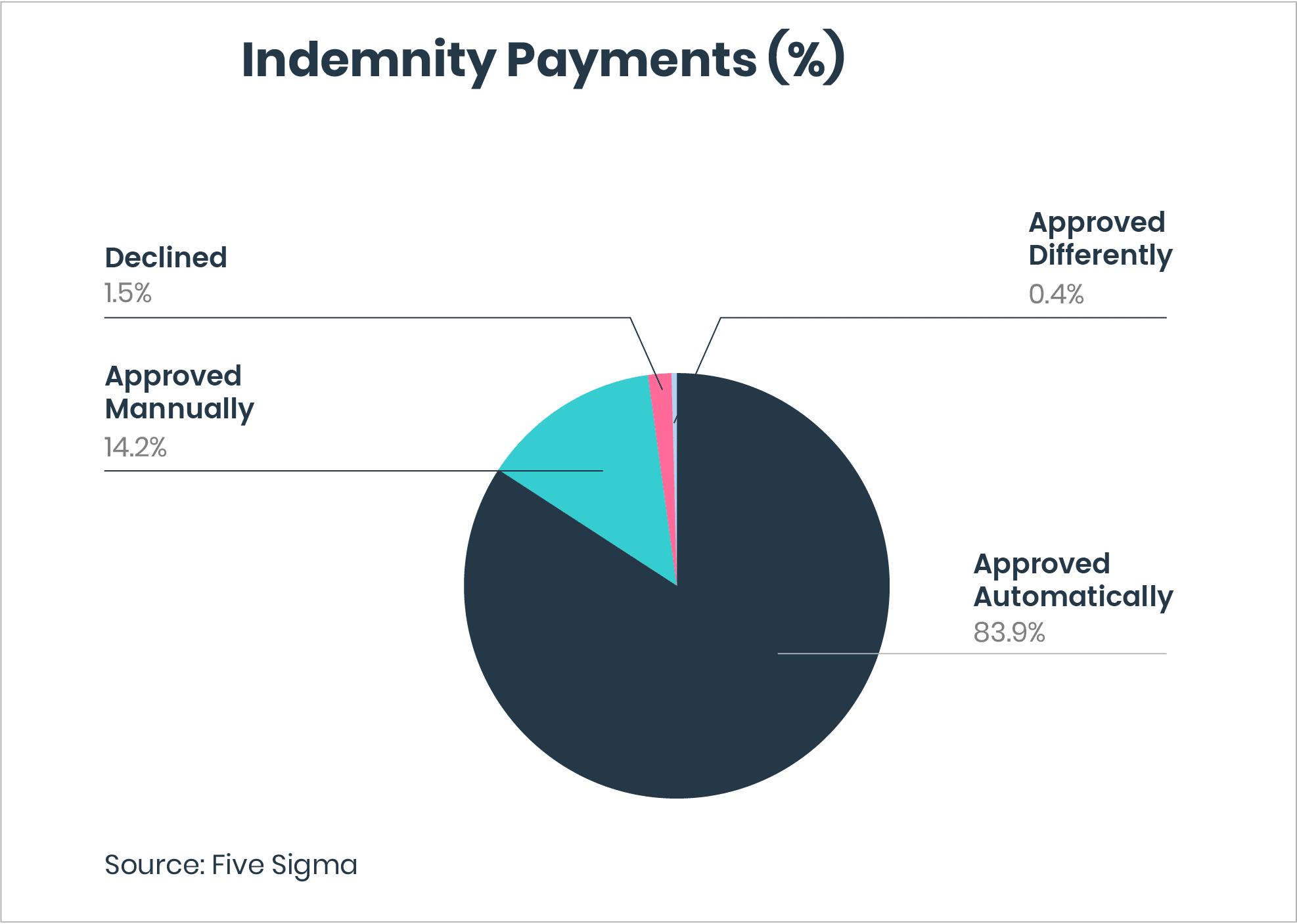

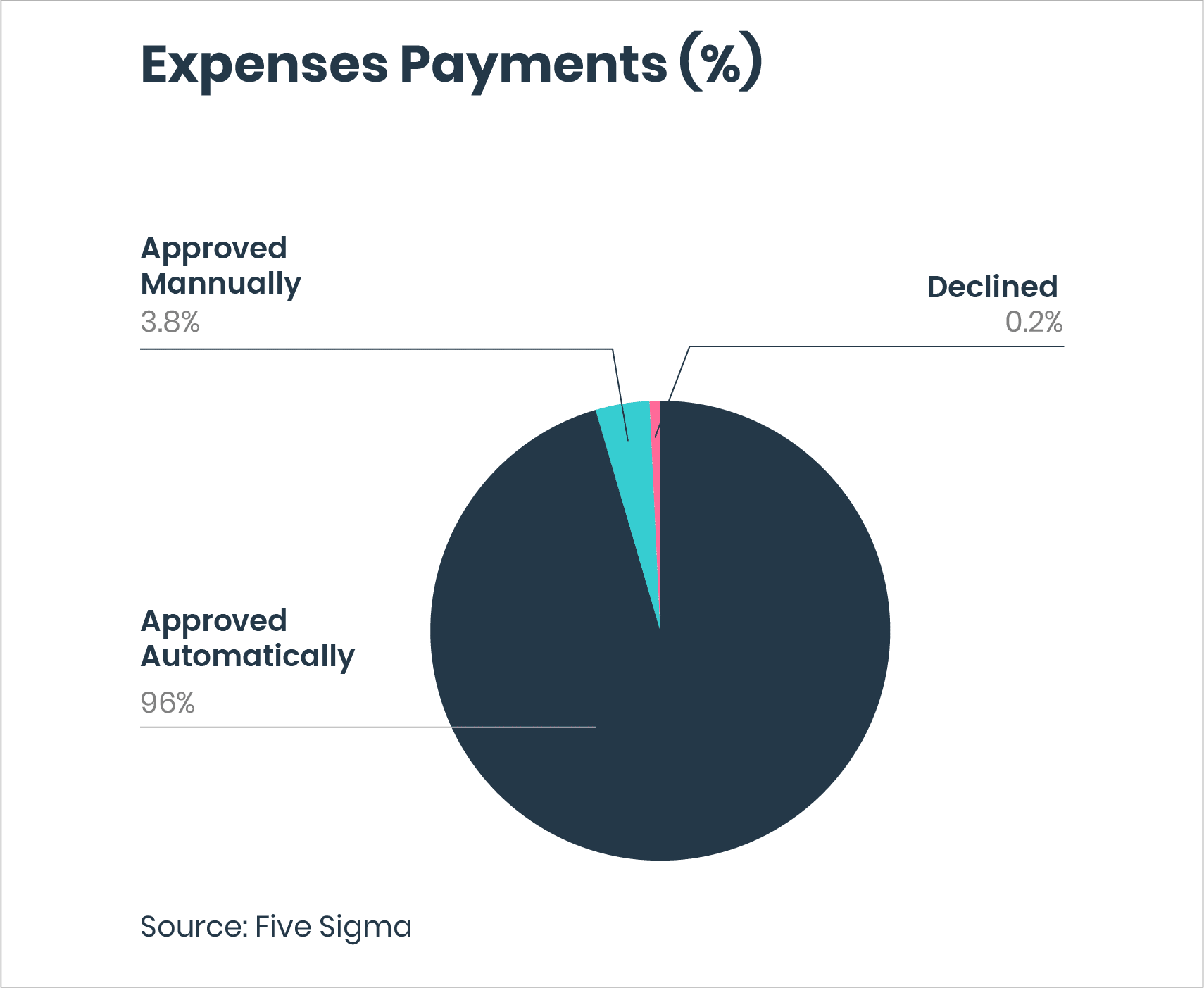

Digitizing your claims payments can have a clear impact on customer satisfaction, but it also increases the efficiency of your operations and can produce immediate cost savings. Based on our findings, 96% of expense payments, and 84% of indemnity payments, are approved automatically. This means that the majority of claims can be settled very quickly with digital payments that eliminate the time and cost associated with printing, mailing and processing checks. Getting claims payments to policyholders faster can also reduce car rental fees, litigation fees, and other claim-related costs that may grow while policyholders wait for checks to arrive and funds to become available.

3. Minimize risk by reducing the chances of human error and fraud

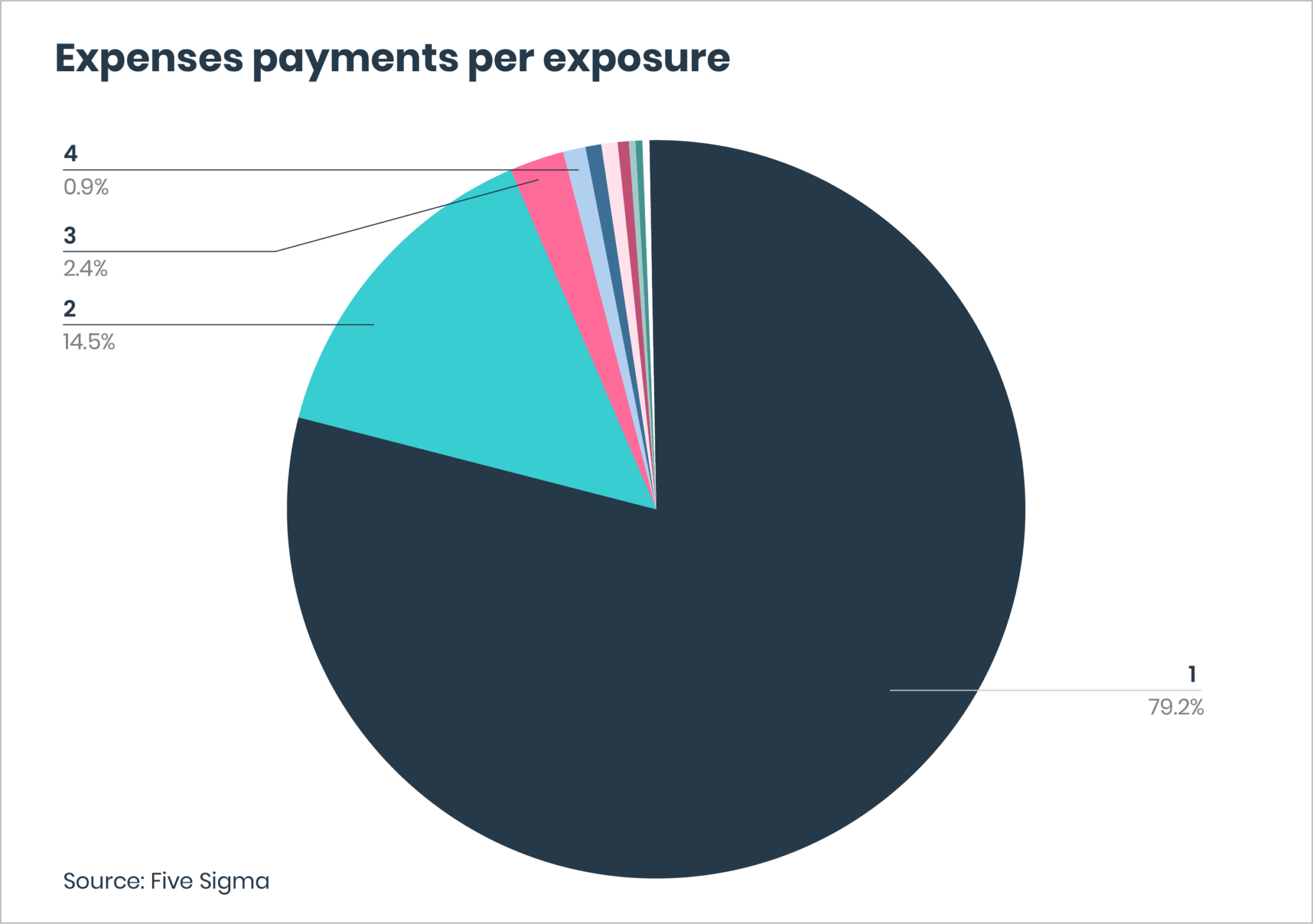

According to our data, 79% of all expense payments can be made with just one digital payment. Digitizing payments reduces the chances of human error and ensures more accurate funds disbursement. And obviously, check fraud is not an issue when you take checks out of the equation.

If you ‘re an insurer, now’s the time to consider digitizing your claims payments process. The resolution of claims represents a large expense that can have a major impact on an insurer’s overall profitability. Resolving claims quickly and accurately boosts insurers’ efficiency, minimizes risk, while also improving the customer experience.

How do insurance companies use data to compile claims intelligence and use this information? For a closer look at the role data plays for insurance companies today and where claims intelligence is headed in the future, check out The State of Claims Intelligence 2022.